The QBO payroll might be reactivated instantly, and you’ll utilize all its features and tools. All licenses from BundleCricut.com are 100 percent genuine and absolutely approved by Intuit, supplying you with full access to payroll updates, tax tables, and help. For help with setting up or troubleshooting QuickBooks Desktop Payroll 2025, be at liberty to achieve out to BizBooksAdvice. Our staff of experts is prepared that will assist you maximize the benefits of QuickBooks and be certain that your payroll runs easily each time. Scalable SolutionWhether you’ve a handful of workers or a large workforce, QuickBooks Desktop Payroll 2025 can scale to fulfill your needs. It is designed to deal with both small and medium-sized businesses, offering a versatile solution that grows together with your company.

Advantages Administration

Make sure you remember to promote the additional time rates, medical insurance costs, bonuses, or mileage reimbursement. In the third step, you want to embrace and alter the benefits offered to your workers. You also should add pay options similar to mileage reimbursements and money advances together with deductions like wage garnishments. Nonetheless, the value of your month-to-month expense or license fee for QuickBooks Desktop doesn’t comprise the payroll.

To take advantage of this service, you should first pay a subscription fee and then set it up on the QuickBooks platform you utilize, be it On-line or Desktop. That’s the place this weblog is useful; we’ll cowl how to arrange payroll in QuickBooks (both Online and Desktop). So with out further ado, let’s get started by first discussing what the QuickBooks Payroll service actually is. Along with paying payroll taxes, you additionally must file the right varieties to report what you’ve paid.

For occasion, an inaccurate EIN may lead to problems when submitting taxes. An easy and straightforward methodology to reactivate the QBDT payroll directly by way of the company file. Once payroll is set up, QuickBooks Desktop makes it simple to manage payroll tasks, from working common pay durations to staying compliant with tax requirements. Whether you’re handling payroll for the primary time or seeking to upgrade your present system, QuickBooks Desktop Payroll will help you handle your payroll tasks with confidence.

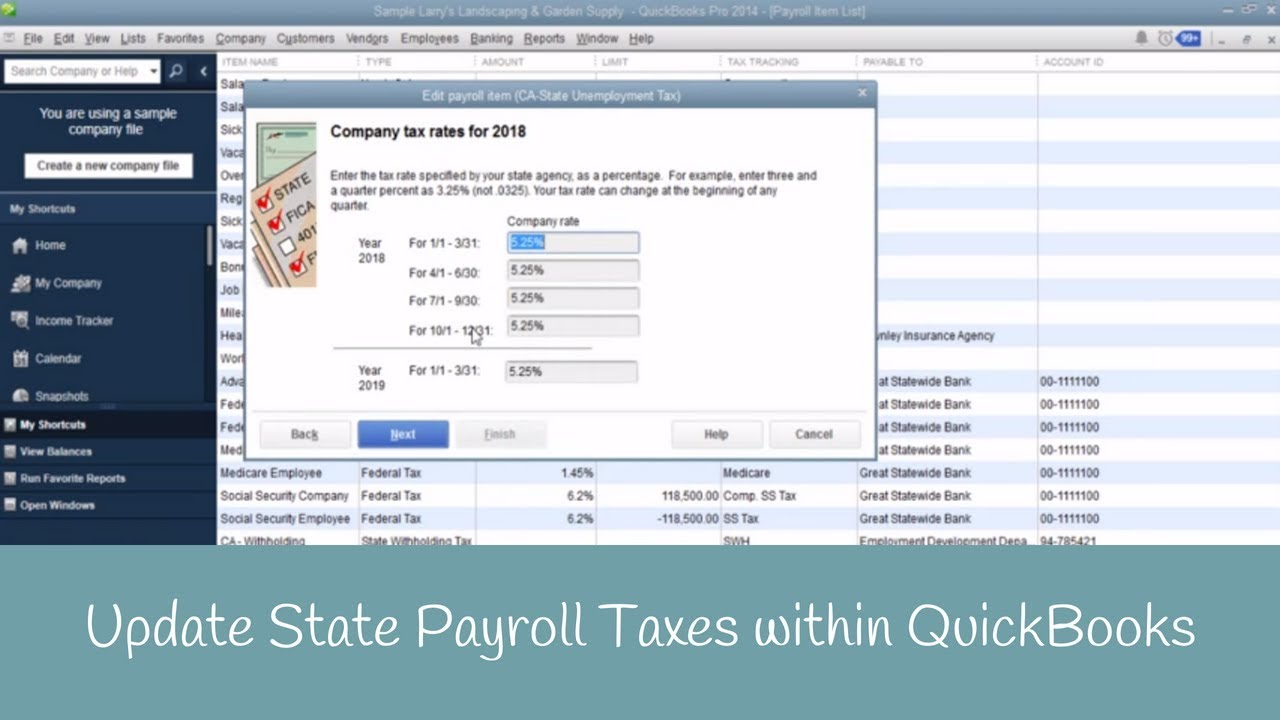

Are The Updates For Quickbooks Payroll Crucial?

FICA requires employers and staff to contribute to Social Security and Medicare. Every pays 6.2% for Social Security and 1.45% for Medicare, including up to 15.3%. Pay dates, including the size of every pay period and when you pay workers after that.

Please read this Disclaimer carefully earlier than utilizing the Accountinghelpline.com Website, as it incorporates important information concerning the constraints of our legal responsibility payroll in quickbooks desktop. Your entry to and use of the Website is conditional upon your acceptance of and compliance with this Disclaimer. This Disclaimer applies to everybody, including, however not restricted to, guests, users, and others who want to access or use the Web Site. By accessing or using the Website, you conform to be certain by this Disclaimer.

There are several disadvantages to QuickBooks Desktop, including an outdated interface, Mac compatibility points, comparatively limited payroll options, and a high worth point. If you’re not in want of immediate assist, the QuickBooks Community forum is frequented by QuickBooks experts and actual staff that can help you troubleshoot your issues. It serves as a built-in assist directory, as most solutions will guide you to a relevant assist article or video. Via the QuickBooks Workforce portal, new employees will be capable of set their bank accounts, addresses, telephone numbers, W-4s, https://www.quickbooks-payroll.org/ SSNs, and birthdates.

In this article, you will get a step-by-step information to learn to arrange payroll in QuickBooks Desktop, what kind of enterprise should set up payroll, and the way to run your payroll. Firstly, you need to ensure that you have got a quantity of particulars handy, corresponding to basic employee particulars, their deductions, pay schedules, Form W-4s, and pay charges. Then, you must open the QuickBooks Payroll setup from the Employee menu. The major emphasis of our guide will be on payroll processing, a crucial characteristic of the software program.

- Merchant Maverick’s rankings are editorial in nature, and usually are not aggregated from user reviews.

- Then, you should open the QuickBooks Payroll setup from the Employee menu.

- If something’s off—like missing a tax cost or miscalculating wages—you could end up facing penalties from the IRS, state fines, or even legal trouble from staff.

- The software takes care of all of it, allowing you to concentrate on different necessary aspects of your business.

- Intuit doesn’t endorse or approve these services and products, or the opinions of these companies or organizations or individuals.

It caters to companies spanning numerous sizes and industries by integrating payroll administration seamlessly with QuickBooks accounting software program. This payroll resolution eliminates the necessity for guide calculations and minimizes errors for enterprise owners and payroll directors utilizing its advanced features and functionalities. This contains automated calculations, integration with time monitoring, tax compliance, and so on. Payroll is a sophisticated task for companies, particularly these new to finance management. Navigating the intricate calculations and tax withholding without prior expertise leads to errors, penalties, and more.

Intuit Inc. does not warrant that the fabric contained herein will continue to be correct nor that it is completely free of errors when revealed. For occasion, the Age Discrimination in Employment Act (ADEA) requires employers to keep all payroll records for 3 years. That info must include any employee profit plans (including retirement or insurance) and any written seniority or benefit system. The FLSA has a number of requirements that fit into your payroll process, from tracking worker time at work to recordkeeping.

With a payroll policy, worker information, and a direct deposit in place, it’s time to trace hours. The FLSA requires employers to take care of accurate information of labor hours for all non-exempt staff. In most cases, non-exempt (as against exempt) consists of hourly workers. You’ll calculate each employee’s gross pay based mostly on hours worked or wage agreements. Then, they apply necessary deductions similar to federal and state earnings taxes, Social Safety and Medicare (FICA), and any relevant local taxes.